Crypto:El Salvador is on the verge of collapse

A poor Central American country has just become a type of guinea pig, thanks to an entrepreneurial ruler. This allowed us to see in real-time an experiment that put bitcoin to the test.

El Salvador, starring President Najib Bukele, a crypto fan who astonished the globe last year, used the Bitcoin Conference to introduce legislation that would make anything (other than the US dollar) an official method of payment.

Three months later, the plan was put into action, and the results have been pretty unpleasant thus far. For starters, the campaign that was supposed to make bitcoin a widely accepted form of payment was a complete failure.

According to the authors of the study "Are Cryptocurrencies Currencies?" "Bitcoin as Legal Tender in El Salvador," where the introduction argues that the use of bitcoin is concentrated among young males, who (unlike the poorer stratum) have easy access to the banking system.

The authors also believe that, given the circumstances (poor standard of living and pandemic), the concept of digital currency had a great potential to brighten the faces of crypto-evangelists, but the effort failed horribly.

Technically, it is still ongoing, but the results are not encouraging.

A presidential order introduced the Chivo (digital wallet) app in September, reserving the same amount of bitcoin for each resident (equal to $ 30, nearly three days' typical income in El Salvador), but just half of those polled attempted to use the program at all.

Less than half of the most persistent users continued to use Chivo after spending the presidential token of attention, and the percentage of overseas remittances with cryptocurrency lent through digital wallets is just in the single digits.

In other words, bitcoin as an (official) money failed. Despite the immense potential, El Salvador is an extremely poor country where remittances from abroad represent a critical component of inhabitants' low living standards.

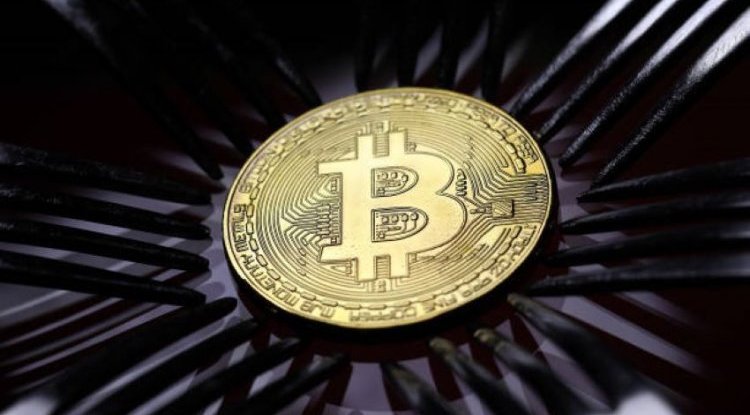

Aside from several technological issues, one of the major reasons for failure, as you might expect, is the enormous volatility in bitcoin's price, which makes it an extremely unreliable means of payment.

That is why, in recent months, American journalists' research expeditions have usually ended in the same way, documenting only a few cases in which transactions (bitcoin payments) have been effectively executed.

Despite the fact that the law requires them to accept bitcoin payments, most entrepreneurs prefer dollars.

There is a remark about the extremely centralized system which actually issued the basic principles of cryptocurrency; in a country where democracy is not flourishing, part of the people considers Chivo initially as a mechanism of control in the hands of the governing set.

And Chivo is only a minor part of a grandiose ambition that has been put on hold for reasonable reasons (deep corrections). The goal was to develop a new city (together with a bitcoin mining factory) using a special bond issue, but the ludicrous creation of a bizarre financial instrument sounded appealing only to hardened cryptocurrency.

They, too, are dissatisfied as a result of the intensive rectification.

"Total Madman" (the government announced a state of emergency in March), crypto-visionary, or simply "El Hodlador" (a humorous nickname given to him by the Financial Times), Bukele has spent hundreds of millions of dollars on bitcoin equities, the market value of which is fast decreasing on Sunday.

According to some estimates, the average purchase price is around 45,000 dollars (bitcoin is currently trading for $30,000), and the loss exceeded 30 million dollars, which is roughly equal to the cost of the next interest rate (on behalf of previously placed bonds) that El Salvador must pay off in June.

Investors simply abandoned the entire story. Just like the IMF and World Bank, which have made collaboration (and future loans) contingent on the demise of bitcoin as legal money.

El Salvador is on the verge of bankruptcy, with public debt reaching 85 percent of GDP, and the performance of conventional bonds leaves no room for doubt: the scale of risk perception (and skepticism about debt collection options) reveals a dramatic increase in yields on bonds maturities in two and a half years exceeded - 50 percent.

This is far from the records set in several Latin American countries, but Bukele will go down in history as the president of the first country to grant bitcoin national currency status.

Unfortunately, he may go down in history as a whimsical autocrat whose aspirations, based on extremely dubious theses, decreased the standard of living for millions of citizens and drove the country into bankruptcy.